Contribution margin percentage formula

Contribution Margin Formula. The contribution margin ratio refers to the difference between your sales and variable expenses expressed as a percentage.

The Difference Between Gross Profit Margin And Net Profit Margin Net Profit Profit Company Financials

What Is Net Profit Margin.

. Alternatively it is known as the contribution to sales ratio or Profit Volume ratio. Dumfries News Dumfries and Galloway old folk buying less food to save money for energy bills A survey of Food Train members has revealed heartbreaking and alarming feedback from the elderly. The margin of safety formula is calculated by subtracting the break-even sales from the budgeted or projected sales.

To Calculate contribution per mix. The numerator of the formula ie contribution margin can be calculated using simple contribution margin equation or by preparing a contribution margin income statement. If a company has a 20 net profit margin for example that means that it keeps 020 for every 1 in sales revenue.

ABC is currently achieving a 65 percent gross profit in her furniture business. The contribution margin formula is practical and simple. The above formula is derived as follows.

The following information is given. We can represent contribution margin in percentage as well. If your contribution margin percentage changes.

Formula for Contribution Margin. Gautam has started a new business in the gym around a year ago. 2 You can use contribution margins to reduce costs associated with.

Gross Profit Margin can be calculated by using Gross Profit Margin Formula as follows Gross Profit Margin Formula Net Sales-Cost of Raw Materials Net Sales Gross Profit Margin 100000- 35000 100000 Gross Profit Margin 65. This formula shows the total number of sales above the breakeven point. Relevance and Use of Current Yield of Bond Formula.

We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply. In other words the total number of sales dollars that. He was inexperienced in the business and he feels he has made adequate sales to recover from loss and appears to be making a profit.

It also measures whether a product is generating enough revenue to pay for fixed costs and determines the profit it is generating. Finally the formula for a current yield of the bond can be derived by dividing the expected annual coupon payment step 1 by its current market price step 2 and expressed in percentage as shown below. They use this margin of safety formula to calculate and ensure that their budgeted sales are greater than the breakeven sales.

The contribution margin is 6000 - 1000 5000. Finally the percentage change formula can be expressed as the change increase or decrease in value step 3 divided by its original value step 1 which is then multiplied by 100 as shown below. Price per share as of December 14 2018 16548.

Variable costs total 1000. CM SP N VC N Where CM is the contribution margin. Margin of safety in percentage 12000 unit 10000 unit12000 unit 100.

The contribution margin per shoe is 500000. The formula should divide the profit by the amount of the sale or C2A2100 to produce a percentage. Profit Margin 10 Profit Margin Formula Example 2.

To illustrate the computation of levered beta. N is the number of units sold. It measures how effectively a company operates.

The formula for contribution margin dollars-per-unit is. The phrase contribution margin can also refer to a per unit measure. The contribution margin can be calculated in dollars units.

Contribution Margin Net Sales Revenue Variable Costs. That sounds like a good result. 3 2 balls 140 1 racquet 7.

Now we will see an application problem of expected return. It is a public listed company and as per available information its unlevered beta of 09 while its total debt and market capitalization stood at 120 million and 380 million respectively as on December 31 2018. Total revenue variable costs of units sold.

The contribution margin ratio shows a margin of 60 600010000. Percentage Change New Value Original Value Original Value 100. Get 247 customer support help when you place a homework help service order with us.

The contribution from sales helps the business be on track. PE Ratio is Calculated Using Formula. Contribution margin presented as a or in absolute dollars can be presented as the total amount amount for each product line amount per unit product or as a ratio or percentage of net sales.

The contribution margin ratio shows a margin of 83 50006000. From the perspective of the matching principle one breaks down the revenue from a given sale into a part to cover the Unit Variable Cost and a part to offset against the Total Fixed Costs. Breaking down Total Costs.

In terms of computing the amount. But this same café also sells muffins. The Revenue from all muffins sold in March is 6000.

Unit contribution margin per unit denotes the profit potential of a product or activity from the. Annual Earnings per share for year ended Sept 302018 1191. We can calculate Net Present Value using the expected return or the hurdle rate from the CAPM formula as a discounted rate to estimate the net present value of an investment.

The Contribution Margin Ratio is the percentage of Contribution over Total Revenue. The following formula is used to calculate the contribution margin. Let us take the example of a company named JKL Inc.

The ratio is also shown in percentage form as follows. Thus the following structure of the contribution margin income statement will help you to understand the contribution margin formula. Contribution margin is a cost accounting concept that allows a company to determine the profitability of individual products.

SP is the selling price per unit. Current Yield Annual Coupon Payment Current Market Price of Bond 100. Relevance and Uses of Percentage Change Formula.

This ratio represents the percentage of sales income available to cover its fixed cost expenses and to provide operating income to a firm. So the hurdle rate or expected return from the project is. With our money back guarantee our customers have the right to request and get a refund at any stage of their order in case something goes wrong.

The contribution margin is the amount of money a business has to cover its fixed costs and contribute to net profit or loss after paying variable costs. The net profit margin is a ratio that compares a companys profits to the total amount of money it brings in. Levered Beta Formula Example 1.

In the example the formula would calculate 1725 100 to produce 68 percent profit margin. For example a company sells 10000 shoes for total revenue of 500000 with a cost of goods sold of 250000 and a shipping and labor expense of 200000. That is this ratio.

Gross Margin Formula In Percentage Form Net Sales COGS 100 Net Sales. Calculating the Margin of Safety in percentage. Contribution margin percentage 60000150000 100.

Contribution Margin Formula. What is Gross Margin Formula. The formula can be written as follows.

For example if we want to accumulate a profit of 500 and earn a contribution of 5 per unit we must sell at least 100 units to meet.

How To Calculate Gross Margin Percentage Gross Margin Percentage Calculator

Break Even Sales Formula Calculator Examples With Excel Template Excel Templates Formula Sales And Marketing

Expert Advice On How To Calculate Gross Profit Margin Wikihow Online College Online Tutoring Financial Ratio

How To Calculate Percentage Difference Between Two Numbers In Excel Excel Find Percentage Calculator

Excel Formula Get Profit Margin Percentage Excel Formula Excel Tutorials Start Up Business

Excel Formula To Add Percentage Markup Excel Formula Excel Microsoft Excel

Cost Volume Profit Analysis Cost Accounting Analysis Contribution Margin

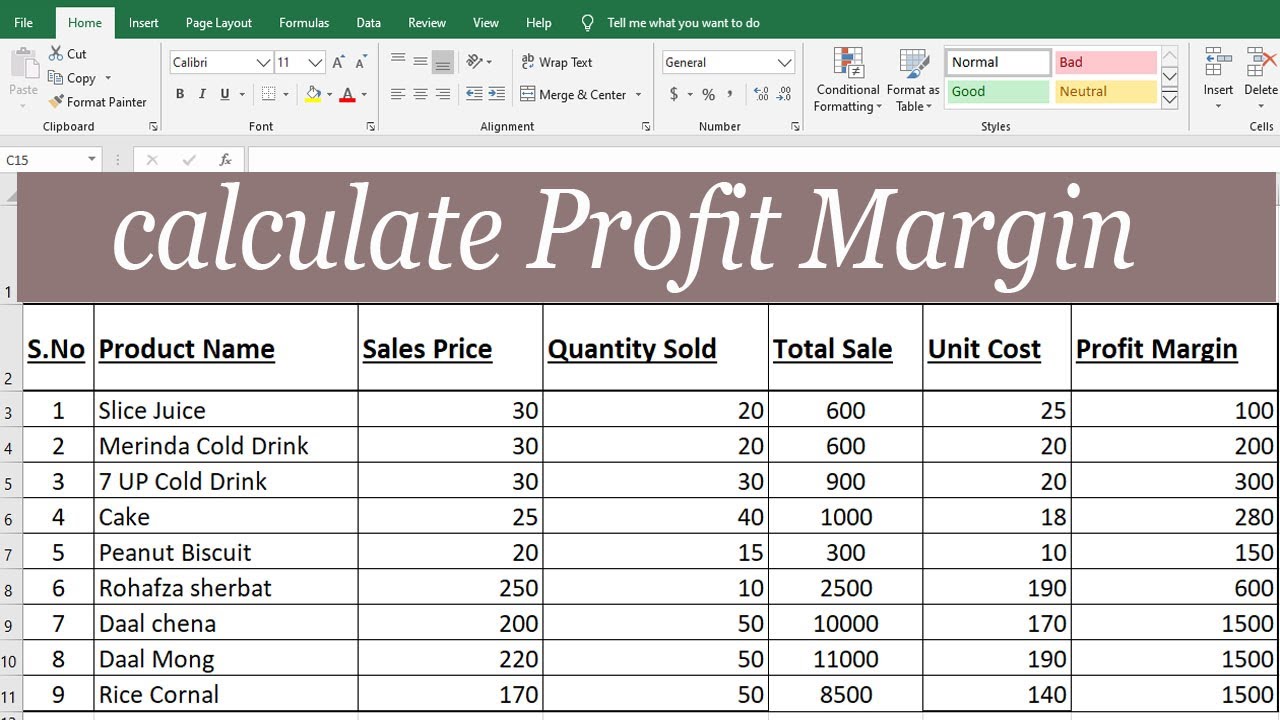

Calculate Profit Margin With Percentage In Excel By Learning Center In U Excel Tutorials Learning Centers Excel

How To Calculate Gross Margin Percentage In Excel By Learning Center In Learning Centers Gross Margin Excel Tutorials

Cvp Analysis Guide How To Perform Cost Volume Profit Analysis Financial Statement Analysis Financial Analysis Analysis

I Found This Formulae Very Helpful It Shoes Four Different Ways Of Calculating Degree Of Operating Leverag Contribution Margin Financial Management Fixed Cost

Margin Definition Gross Profit Margin Profit Margin Formula Operating Profit Margin Infographic Economics Lessons Accounting And Finance Finance Investing

Gross Profit Percentage Meaning Example Advantages And More Accounting Education Economics Lessons Learn Accounting

Food Costs Formula How To Calculate Restaurant Food Cost Percentage Youtube Food Cost Restaurant Recipes Catering Food

Airbnb Stay Tracker And Management Expense Cleaning Fee Etsy Rental Income Being A Landlord Rental Property Management

Gross Profit Vs Net Profit Definitions Formulas Examples Net Profit Accounting Training Profit

Churn Rate Formula How To Calculate Churn Rate Examples Churn Rate Formula Financial Analysis